(FE)

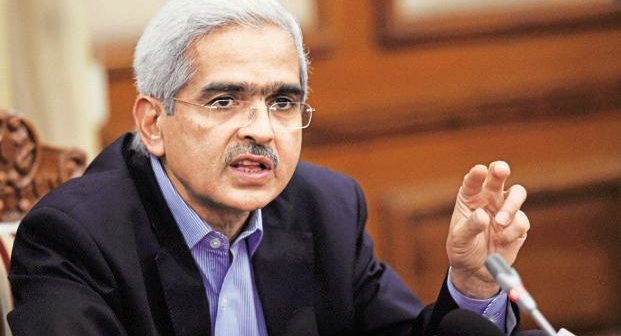

Given the current and evolving inflation and growth scenario, it can no longer be a business-as-usual approach and supporting growth must be a priority, Reserve Bank of India (RBI) governor Shaktikanta Das wrote in the minutes to the monetary policy committee’s (MPC) August meeting while voting for a 35 basis point (bps) cut in the repo rate. Other members of the committee pointed to risks arising out of fiscal slippage, sought reforms to complement the rate easing cycle and flagged a rising trend in food inflation.

Das observed that economic activity has shown signs of further weakening since the last MPC meeting in June 2019. Several high frequency indicators have either slowed down or contracted in recent months. Headline Consumer Price Index (CPI) inflation has evolved broadly along the projected lines; CPI inflation, excluding food and fuel, continued to soften, while food inflation has edged up. The softening in core inflation reflects subdued input cost pressures relating to both agriculture and industrial raw materials. Inflation expectations of households are gradually getting better anchored. “Overall, the inflation situation remains benign,” Das wrote, adding, “The impact of monetary policy easing since February 2019 and favourable base effects are expected to support GDP (gross domestic product) growth, especially in the second half of the year.” Credit growth has slowed down somewhat in the recent period; credit to micro, small and medium enterprises, in particular, remains anaemic, the governor said.